For some the budgeting looks intimidating. It looked so for me before I started. To tell the truth, it was so intimidating, that I postponed my decision to start a budget for almost 20 years.

Now I face a new challenge: I am trying to bring my knowledge to my 12-years old daughter. I literally have a 5-10 minutes span of attention to bring all the wisdom I acquired. That is how I created the explanation. Hopefully, it will be useful for others, too.

All things are difficult before they are easy.

Thomas Fuller

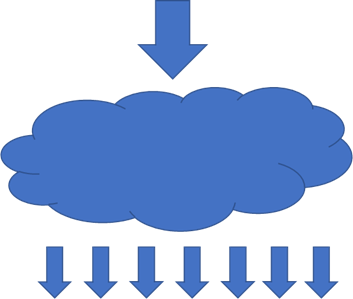

Everybody has some sort of income. Imagine the money you have as a cloud, and then you have a rain of spending: drops of streams of your expenses.

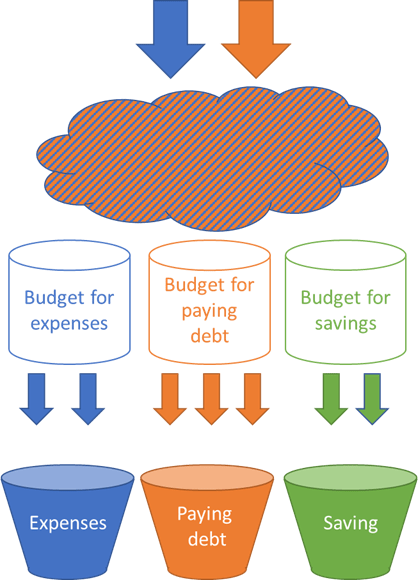

For an adult, the picture is a little bit more complicated: you can have several streams of income. Moreover, you can use debt and treat it as income as well.

As for spending, here the picture is not easier: you have day-to-day expenses (food, a place to live, clothes, and fun), you also need to pay back the debt you acquire, and as a conscious adult, you need to save for big purchase or retirement. So, you have the 3 buckets of expenses.

The blurred picture does look intimidating, and many adults subconsciously are trying to avoid dealing with the colorful cloud producing the colorful rain.

What is budgeting?

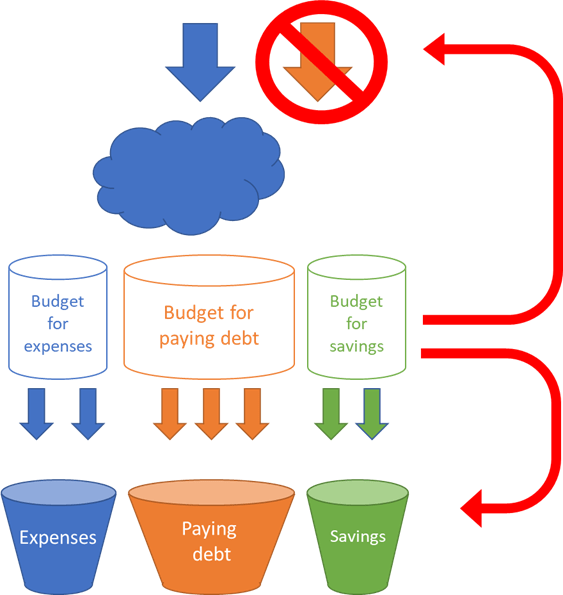

In a simple analogy, it is creating pipes in between the cloud (money you have at hand or within the reach) and your buckets of expenses. The pipes will deliver the flow of money directly to specified buckets.

In the real world, it is setting up a plan for what you are going to spend for the buckets in the future (next week, next month, or whatever future you can plan).

Why is it so powerful?

The trick is that though regulating the size of pipes you both directly influence the size of your buckets (your actual expenses), and control the income flow. You might not need credit inflow and will deal only with money you own (vs. other’s people money you borrowed).

That is all! It is simple like that.

Everything else is just a detail or method of budgeting. It is much easier to understand them if you keep the bigger picture of the concept in mind.

[…] into details overloading with rules without prior explaining what budgeting is. I wrote the post Budgeting in plain English when I tried to explain the principle to my 12 years old […]

LikeLike